Quick Answer:

Sales Tax is always paid by the buyer, not the seller.

Capital Gain Tax is paid by the seller, but only if you sell your car for more than you paid for it. Selling your car for less than you bought it for means no taxes paid to the IRS.

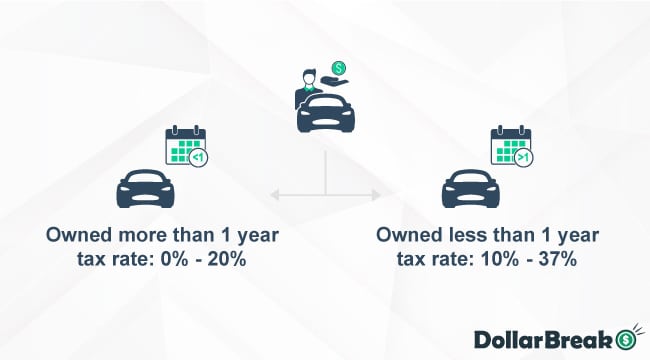

The amount of Capital Gain Tax depends on a few factors: your income level, how long you held the asset, and the amount of capital gain. Depending on these factors, you can expect to pay 15% to 20 % for long-term capital gain and anywhere between 10% and 37% for short-term capital gain.

Key Takeaways:

- Sales Tax Liability: The responsibility for paying sales tax lies with the buyer, not the seller, in a car sale transaction.

- Capital Gain Tax Considerations: Sellers need to pay Capital Gain Tax if the car is sold for more than its purchase price. The tax rate varies based on factors like the duration of ownership and the seller’s income level.

- Determining Capital Gain: To calculate capital gain, subtract the original purchase price and any improvement costs from the sale price. This calculation determines whether the sale resulted in a profit or a loss.

- Reporting and Paying Tax: If the sale results in a capital gain, the seller must report it on their tax returns using IRS Form 1040, Schedule D. The tax rate depends on whether the gain is short-term or long-term.

Best Used Car Buyers

Peddle

Trustpilot Rating

Get a legit offer in minutes – provide VIN, mileage and condition

$0 fees + you don’t have to pay for towing – Peddle will take care of it

Get paid in check during the pick up for any car (damaged, junk)

Wheelzy

Trustpilot Rating

Quick car evaluation without the hassle – sell your car within 30 min

Choose a convenient date and time for free pick-up, even tomorrow

Get cash in hand the same day the Wheelzy agent picks up your car

How To Calculate Capital Gain Taxes?

To find out your capital gain for selling a used car, you need to sum the initial value of your car (how much you paid) and any costs of improvements, then deduct this sum from the sale price.

Let’s take this for an example: you bought a car for $30,000, repainted the front left door for $400, and renewed the infotainment system for $500. You have sold your car for $31,000.

When you deduct the initial price and value of the improvements from the sale price, you realize a capital gain of $100.

This means, depending on your income, you are required to pay $0-$20 if you owned a car for more than a year or $10-$37 if you owned it for less than a year.

Long-Term Capital Gain Taxes

If you have owned your car for more than a year, it is counted as a long-term asset, and depending on your situation and income, you will be required to pay a 0%, 15%, or 20% tax fee.

For example, if you are a single individual and your income is less than $47,025, you won’t need to pay a capital gain tax. But if you earn anywhere between $47,026 – $518,900, your tax rate will be 15%.

If you are married but filing tax returns separately, the boundaries are lower than if you filed jointly.

Long-term capital gains tax rates for the tax year:

| Tax rate | Single | Married filing jointly | Married filing singly | Head of household |

|---|---|---|---|---|

| 0% rate | Up to $47,025 | Up to $94,050 | Up to $47,025 | Up to $63,000 |

| 15% rate | $47,026 – $518,900 | $94,051 – $583,750 | $47,026 – $291,850 | $63,001 – $551,350 |

| 20% rate | Over $518,900 | Over $583,750 | Over $291,850 | Over $551,350 |

Short-Term Capital Gain Taxes

If you have owned your car for less than a year, it is counted as a short-term asset. Depending on your situation and income, you will be required to pay a 10%, 12%, 22%, 24%, 32%, 35% or 37% tax fee.

There is no 0% tax exception for short-term capital gain, so you will still need to pay at least a 10% tax fee.

For example, if you are a single individual and your income is less than $11,600, you will need to pay a capital gain tax of 10%. If your salary is anywhere between $47,150– $100,525 rate increases to 22%.

If you are married but filing tax returns separately, the boundaries are lower than if you filed jointly.

Short-term capital gains tax rates for the tax year:

| Tax rate | Single | Married filing jointly | Married filing singly | Head of household |

|---|---|---|---|---|

| 10% | $0 – $11,600 | $0 – $23,200 | $0 – $11,600 | $0 – $16,550 |

| 12% | $11,600 – $47,150 | $23,200 – $94,300 | $11,600 – $47,150 | $16,550 – $63,100 |

| 22% | $47,150 – $100,525 | $94,300 – $201,050 | $47,150 – $100,525 | $63,100 – $100,500 |

| 0.24 | $100,525 – $191,950 | $201,050 – $383,900 | $100,525 – $191,950 | $100,500 – $191,950 |

| 32% | $191,950 – $243,725 | $383,900 – $487,450 | $191,950 – $243,725 | $191,950 – $243,700 |

| 35% | $243,725 – $609,350 | $487,450 – $731,200 | $243,725 – $365,600 | $243,700 – $609,350 |

| 37% | $609,350+ | $731,200+ | $365,600+ | $609,350+ |

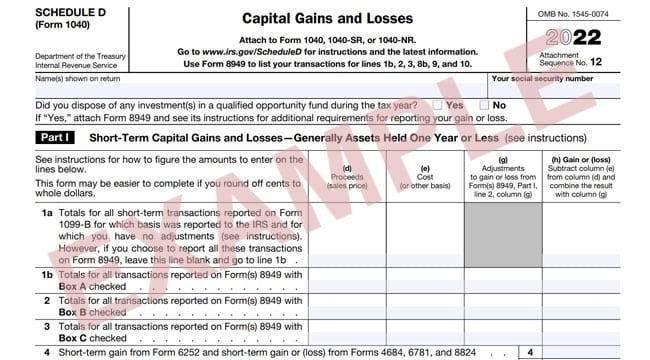

How to Pay Capital Gain Tax?

If you sell your car for less and do not gain capital, you do not need to report the transaction on your tax returns. Money loss on personal car sales is not tax deductible.

If, after all, you are eligible for paying capital gain, you need to report a transaction when filing tax returns for the year.

To report profit, you need to fill out IRS Form 1040, Schedule D, and report if this is a short-term or long-term gain.

You might need to provide supporting documentation, such as proving your purchase price, improvement costs, and sale evidence.

What If You Sold a Car For Profit And Didn’t Report It?

If you fail to report capital gains, the IRS will likely find the mismatch via other reporting mechanisms. If this happens, the IRS has full authority to impose fines and penalties for your negligence, and as a matter of fact, they often do.

If the IRS proves that this was done intentionally and the act was fraudulent, you might face criminal prosecution.

If you fail to file taxes, you can be charged a 5% fee on the amount you owe for each late month. The maximum penalty is 25%, and if the filing is 60 days late, the penalty is either $205 or 100% of the total value.

If you do not file your return within three years, you lose the right to claim your refund.

Taxes When Selling a Business Vehicle

If you sell a business vehicle for a profit, it is classified as a capital gain for the business. You must report this income when you file taxes for your business instead of personal taxes.

If you are a sole proprietor, you do not file a separate business tax return; instead, you need to report everything, including the capital gains from selling the business vehicle, on your individual tax return.

If you sell a business card for a loss, you can reduce your business’s tax liability by subtracting the loss from your business profits.

I advise you to consult your tax advisor to determine the best way to report such transactions and lower your tax obligations.

Way to Deduct Taxes When Trading In

Despite the method you choose to sell your car, you are still required to pay capital gain tax if applicable.

If you are planning to buy a new car, trading in might save you some tax money. In this case, you, as a seller, will be required to pay sales tax.

If you trade your used car in and buy a new one, you only need to pay sales tax from the difference between the trade-in and purchase price.

For example, if you trade in your car via Peddle for $4000 and your new car’s value is $22,000, you only need to pay sales tax from the $18,000 ($22,000-$4000=$18,000).

In another scenario, if you are buying privately, for example, you will need to pay sales tax from the whole purchase price ($22,000).

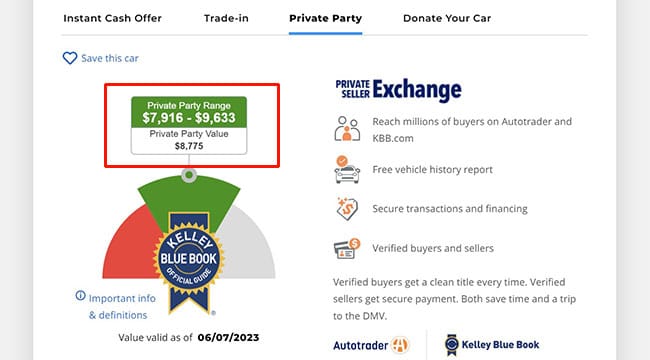

How to Set a Car’s Value for Free?

Even though there are no pre-determined car value depreciation rates, it’s commonly estimated that the vehicle’s value decreases by 20% in the first year. Subsequently, the annual depreciation rate is typically around 15%.

It is estimated that car loses half their value after five years.

The best way to find out the market price of your car is by filling out an online form on Kelley Blue Book.

To get a free car’s value estimate, describe your car by adding the following:

- Year, Make, and Model

- Mileage

- Zip Code

- Style, Equipment, and Color

- Car’s condition

In a few minutes’ time, you will get a recommended price range and can even get an instant cash offer or trade-in your car.

This is important to consider when setting the selling price, as it impacts whether you will get capital gain or not.

While it is highly unlikely that you will sell your used car for a higher price than you bought it, it depends on investments made and the overall economic situation.

However, if you want to calculate the value of made improvements, you should note that everything considered necessary to keep a car in working condition does not qualify as improvements.

These are examples of qualifying improvements:

- Replaced or added sound system

- Replaced or added an infotainment system

- Repainted parts

- Fixed visual defects

- Replaced or added seats

- Added turbochargers and superchargers

- Etc

To prove the car’s value and justify tax relief, you will need to provide evidence of work done. This means you should keep all receipts, invoices, contracts, or any other evidence proving the reasonableness of the expenses incurred.

Additional Fees When Selling

Depending on your state and county, there might be additional fees when selling and transferring ownership of the vehicle.

For example, in some states, like California, to sell a car, you need to have a valid smog certificate or registration tag – if you fail to obtain this, the deal can’t be officially registered.

Also, if you have lost paperwork needed to sell a car, you might need to pay for duplicates.

Paperwork you will need to sell a car privately:

- Certificate of Title

- Odometer readings

- Release of Liability

- Valid Registration Tag (required in some states)

- Valid Emissions Test (required in some states)

- Bill of Sale (required in some states)